Crowdfunding turned “I have an idea” into “I have backers.” It democratized capital, let niche products find their tribe, and gave communities a way to help fast. It also handed grifters a velvet rope to your wallet. If everyone’s a VC with a credit card, scammers are speed-running due diligence. Here’s what the evidence shows about how crowdfunding scams actually operate in 2025 and how founders, backers, and platforms can close the holes they slither through.

Crowdfunding isn’t one thing

Start with the taxonomy. Donation and reward campaigns (think GoFundMe, Kickstarter) sit alongside regulated investment and loan platforms (equity and P2P lending). They look similar on your phone; they’re policed very differently in law. In the UK, for example, the Financial Conduct Authority (FCA) regulates investment- and loan-based crowdfunding, but not donation/reward campaigns. If you mistake one for the other, you’ll expect protections you don’t actually have.

Across the EU, investment/loan platforms must now comply with the European Crowdfunding Service Providers Regulation (ECSPR). That framework forces standardized risk disclosures (“KIIS” documents), marketing rules, and authorization requirements, raising the bar for platforms that actually sell investments rather than T-shirts. Donation and reward sites aren’t in scope. Translation: similar UI, very different seatbelts.

Failure vs. fraud: the line scammers hide behind

Projects fail. Supply chains snap, molds crack, founders underestimate costs. That’s not automatically fraud. In a large independent study for Kickstarter, researchers found about 9% of successfully funded projects ultimately failed to deliver rewards. That’s not great, but it’s not the apocalypse, and it’s far from proof that “everything is a scam.” It does, however, provide cover for the real scammers, who mimic the early signs of legitimate failure.

Playbook #1: Vaporware with vibes

The most reliable red flag in reward crowdfunding: glossy renders, zero working prototype. A classic: the Skarp Laser Razor, which promised to cut hair with light. Kickstarter killed the campaign in 2015 for violating the “working prototype” rule, an early, crucial policy change that banned photorealistic renderings and required functional prototypes in tech/design categories. (If you can’t shave with it today, don’t ask for money to ship a million tomorrow.)

Even when platforms miss the first pass, the internet’s volunteer auditors sharpen their knives. Communities like r/ShittyKickstarters have become surprisingly effective forensic labs, picking apart physics claims, reverse-image-searching “factory” photos, and flagging recycled scam copy. That grassroots scrutiny has torpedoed a procession of impossible gadgets before they vacuumed up more cash. Crowd against crowd, and sometimes the good crowd wins.

Playbook #2: “Charity” as cover story

Donation crowdfunding is a magnet for angels and opportunists. Because donors aren’t buying a product or security, the legal rails are lighter. Platforms fight abuse with policy and tooling. GoFundMe, for instance, markets a Giving Guarantee that promises donors a refund if something isn’t right and a Beneficiary Guarantee if funds don’t reach the intended person. That’s a real backstop (subject to terms), and the company publicizes refunds in high-profile misuse cases. But it’s still reactive: money can move before truth catches up.

If you want recent, human-messy examples, there are plenty: alleged medical hoaxes and sensational “family in crisis” stories that later unravel, followed by platform shutdowns and donor refunds. The patterns rhyme: emotional narratives, urgent asks, thin verifiable detail. (Heartstrings are not evidence.)

Playbook #3: The investment mirage

The most financially destructive cases haven’t been $99 gadgets; they’ve been European P2P “platforms” that collapsed under fraud allegations – Kuetzal and Envestio among them – wiping out millions from retail investors in 2019–2020. Both promised double-digit yields from loans that later looked… not real. Police investigations followed; thousands of investors were left chasing cross-border justice. These blowups sped up Europe’s move to harmonized rules (ECSPR), because scammers exploit regulatory arbitrage the way water finds the crack in a dam.

When platforms fight back

Crowdfunding sites are not bystanders anymore. Kickstarter’s prototype rules were the first real “seatbelts.” After Zano, then Europe’s biggest Kickstarter flop, imploded, Kickstarter did something rare: it commissioned an independent journalistic investigation into what went wrong and published it. That kind of radical sunlight doesn’t resurrect backers’ money, but, it does teach the next cohort what failure looks like from the inside.

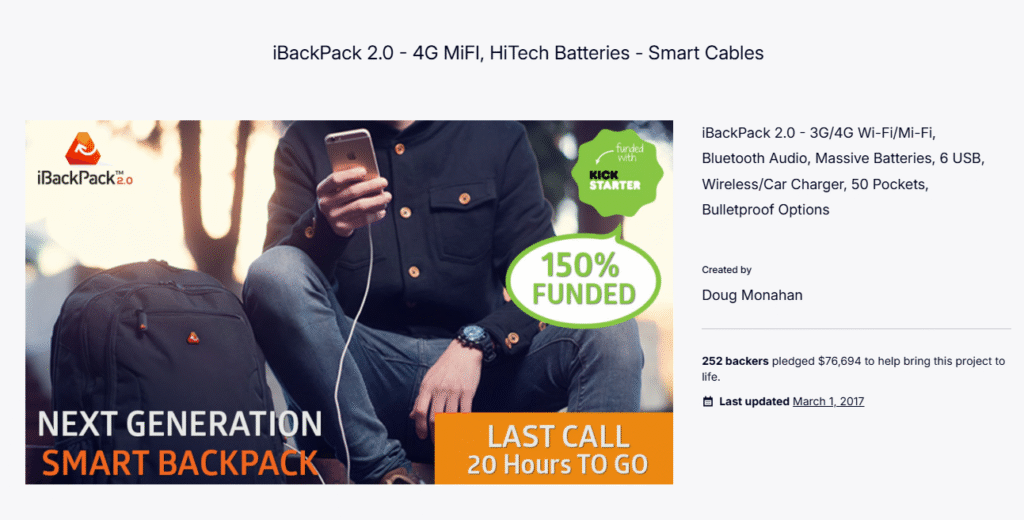

Regulators have discovered the terrain too. In the U.S., the FTC sued the creator of iBackPack for using backers’ funds on personal expenses after raising nearly $800,000 across platforms. The case ended with a ban on future crowdfunding for the founder, a clear signal that “it’s just a perk” doesn’t immunize you from consumer-protection law.

In Europe, ECSPR forces licensed platforms to provide standardized disclosures, run appropriateness checks on investors, and keep marketing honest. That won’t make bad projects good, but it does make it harder for a platform to become a crime scene. Investors still need to read the documents (KIIS isn’t a talisman), but there’s at least a spine to hang diligence on.

The anatomy of a scam

After reviewing cases, policies, and the numbers, the same five tells keep appearing:

- Physics-defying claims: “water-powered car,” “pocket fusion,” “laser razor.” If the demo is a render and the prototype can’t be independently tested today, you’re not backing a product, you’re funding a fiction workshop. Kickstarter literally bans photorealistic simulations for this reason.

- Borrowed credibility: stock photos of factories, unverified “partnerships,” fake certificates. Communities catch these because they’re easy to cross-check. (If the “manufacturer” is a Shenzhen hotel on Google Maps, that’s not a good sign.)

- No supply chain: Real hardware founders can show purchase orders, tooling photos, or a BOM bill of materials and explain lead times. Scammers abstract all of that into “we’re talking to suppliers.” (Sure you are.)

- Tug-the-heartstrings urgency: For donations, the story arrives before the facts. Names and hospitals are “private,” receipts come later, withdrawals are immediate. Platforms may refund, but only after the harm.

- Too-good investment returns: Double-digit yield with zero collateral? Risk “diversified” across loans that don’t exist? We’ve seen this film. Investors exit with a police report and a lesson on jurisdiction.

A 10-minute due-diligence drill (for backers)

- Prototype or it didn’t happen: Look for third-party videos of a working unit, not renders. For wearables/tools, ask for teardown shots or test footage that would be hard to fake. (Platforms can help by enforcing this; some already do.)

- Team receipts: Does the team have prior shipped products you can buy or look up? Are identities verifiable beyond LinkedIn confetti?

- Manufacturing plan: Ask about molds, test runs, certifications (CE, FCC), and the actual factory. Vague equals risk.

- Money story: If the goal is $50k but the BOM screams $500k, you’re looking at wishful math.

- Platform protections: For donations, understand refund policies like the GoFundMe Giving Guarantee. For investments, check the platform is regulated (FCA register in the UK; ECSPR authorization in the EU).

- Community temperature check: Search the project name plus “scam,” and scan watchdog communities. False positives happen, but you’ll often find red flags early.

A credibility checklist

If you’re legit, act like it:

- Ship your prototype on video, under honest constraints. Invite independent reviewers. Kickstarter’s rules aren’t a hurdle; they’re a trust-accelerator.

- Open-book manufacturing: Post your BOM, tooling timeline, and certification plan.

- Bank the boring: Use escrow or milestone-based draws where possible; pre-book factory slots; show POs.

- Over-communicate risk: Borrow the ECSPR’s mindset with clear disclosures, realistic timelines, and what could go wrong. It’s not just compliance; it’s adulting.

- Guardrails for donations: If raising for a person, name the beneficiary, use direct-to-beneficiary withdrawals where available, and publish receipts. If you won’t do this, donors shouldn’t do you.

What platforms should do next

Platforms have moved from “we host” to “we police.” Good. Now go further:

- Prototype verification: Keep (and expand) bans on renders/simulations; require independent prototype tests for high-risk categories before launch. Kickstarter’s precedent shows this is enforceable and effective.

- Supplier attestation: For hardware, require a signed supplier letter and a photo/video verification from a factory contact pre-launch.

- Escrow with milestones: Release funds on objective events (tooling complete, certification passed), not vibes.

- For donations: Default to beneficiary-verified withdrawals; flag campaigns that refuse verification; fast-freeze funds on credible tips and proactively notify donors about refunds under guarantees.

- Signal to regulators: For investment platforms, lean into ECSPR/FCA standards, and publish enforcement stats quarterly. Scammers fear sunlight almost as much as auditors.

The uncomfortable truth

No system will reduce fraud to zero. Scammers read the rulebook too. But the mix of platform rules, regulatory scaffolding, and a surprisingly effective volunteer OSINT community has raised the cost of lying. We’ve watched platforms shut down impossible campaigns (Skarp), backers self-organize to expose nonsense, and regulators ban serial abusers (iBackPack). This is progress.

Meanwhile, the baseline risk of mere failure is quantifiable, and lower than doomers may think. Roughly one in ten funded Kickstarter projects won’t deliver. That’s painful if it’s your one, but it’s a reasonable rate for creative, first-of-its-kind products. If you want guaranteed delivery, that’s called “retail,” and you’ll show up after the innovation risk is gone.

What’s next: deepfakes, AI copycats, and smarter defenses

Looking forward, expect scams to lean on generative AI: emotionally tuned campaign copy, fake founder videos, fabricated testimonials, even synthetic “factory tour” clips. The countermeasures are already available: media forensics (detecting synthetic footage), cryptographic signing of origin video, and platform-level “chain of custody” for prototypes (serial-numbered parts, third-party test reports). ECSPR-style standardization will creep into unregulated corners as the reputational upside becomes obvious: a single, readable dossier of who you are, what you’re building, how the money moves, and how backers get made whole if it goes sideways. That’s how you turn “trust me” into “trust this process.”

Some final words

- Backers: Treat pledges like pre-seed bets. Ten minutes of checking prototypes, teams, supply chains, and policies can save you months of regret.

- Founders: Radical transparency is your moat. If you can’t show the work, don’t ask for the money.

- Platforms/Regulators: Double down on verification, milestone funding, and plain-English disclosures. You’re not killing innovation, you’re defunding fiction.

Crowdfunding remains one of the most hopeful inventions of the internet. Keep the hope; add the homework. The good projects deserve both.