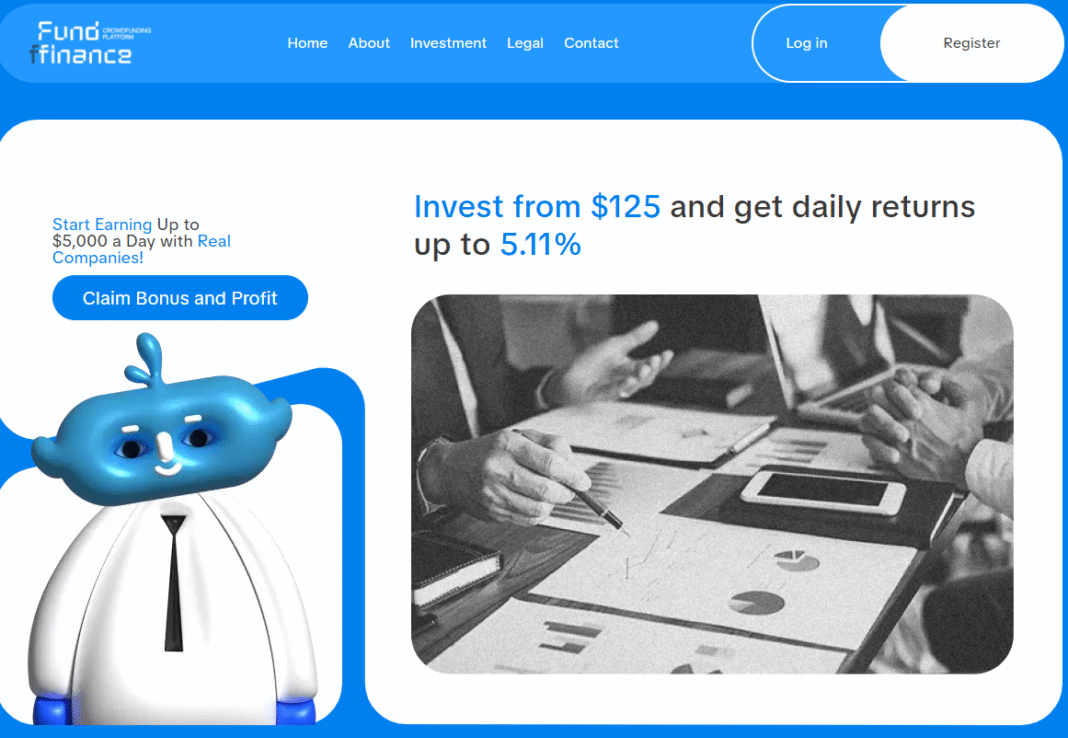

When a financial platform promises investors “daily income up to 5.11%” with no lock-ins and instant withdrawals, most seasoned market observers raise an eyebrow. That was the reaction of an industry professional who recently flagged Fund Finance, a website calling itself a U.S.-registered crowdfunding platform, to the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

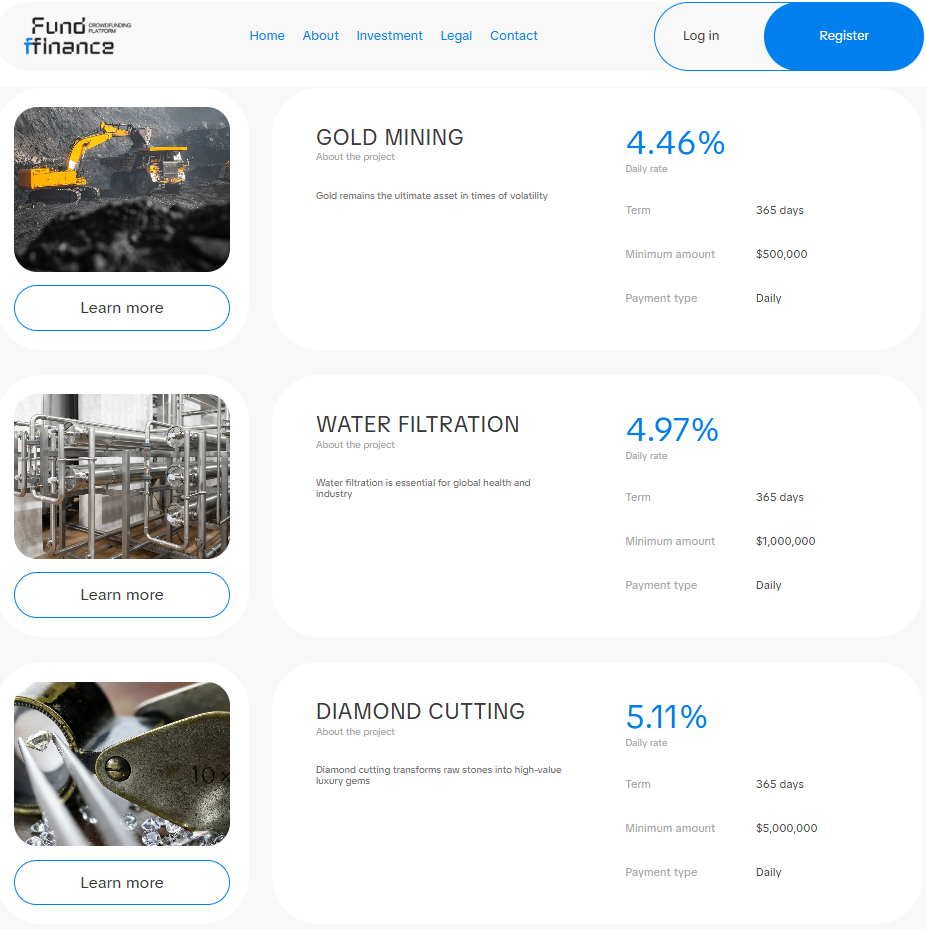

The platform, found at https://fundfinance.io, presents itself as a modern crowdfunding investment opportunity, claiming to channel investor funds into projects as varied as agriculture, diamond cutting, pharmaceuticals, and cannabis. The pitch is simple: invest, sit back, and enjoy reliable, high daily returns.

But behind the slick website and promotional material lies a problem familiar to regulators, financial journalists, and consumer advocates alike: promises that seem far too good to be true.

Promises That Raise Questions

On its website, Fund Finance prominently advertises guaranteed yields that could exceed 100% annually if sustained.

For comparison, most legitimate crowdfunding investments in real estate or startups operating under exemptions such as Regulation CF, Regulation A+, or Regulation D of the JOBS Act warn investors of high risk of total loss. SEC rules explicitly require crowdfunding issuers to disclose risks, historical financials, and offering circulars.

Fund Finance, however, provides none of these disclosures. The company’s “About Us” page asserts a U.S. presence and claims to be registered in Kentucky. Yet a search of the SEC’s EDGAR database yields no filings for Fund Finance. Nor does the firm appear in FINRA’s BrokerCheck, the national database of registered broker-dealers.

“This is a classic hallmark of concern,” said one crowdfunding attorney who spoke on background. “Any platform soliciting investments from U.S. residents must either register with the SEC and FINRA or qualify for an exemption. The absence of filings is a red flag.”

Crowdfunding Rules in the U.S.

Since the passage of the JOBS Act in 2012, equity crowdfunding has operated under carefully constructed exemptions designed to balance innovation with investor protection:

- Regulation CF allows small companies to raise up to $5 million annually but requires offerings to run through SEC-registered funding portals or broker-dealers.

- Regulation A+, sometimes called a “mini IPO,” permits larger raises but requires audited financials and ongoing disclosures.

- Regulation D (506c) allows unlimited fundraising from accredited investors but still requires a Form D filing with the SEC.

Platforms that fall outside these exemptions and still solicit funds from the public risk violating federal securities laws. Enforcement cases in recent years have shown regulators quick to act when platforms blur these legal lines.

Potential Ponzi Structure?

Investor advocates point out that Fund Finance’s structure resembles Ponzi-style schemes rather than regulated crowdfunding. Ponzi schemes operate by paying early investors with funds from newer investors, all while advertising unsustainable returns. They typically collapse when recruitment slows, leaving most investors with heavy losses.

While there is no public enforcement action yet against Fund Finance, its business model checks many of the boxes regulators warn about:

- Guaranteed daily returns far exceeding market norms.

- No lock-in periods – a common tactic to reassure new investors while hiding underlying risk.

- Minimal transparency – no offering memorandum, audited financials, or disclosures.

The SEC itself warns on its website: “Fraudsters may use the appeal of crowdfunding to lure investors with unrealistic returns or claims of guaranteed profits.”

Investor Risks

The greatest risk may be borne by unsophisticated retail investors who encounter the site via online promotions. The platform markets heavily on accessibility, promising participation from as little as a few hundred dollars. This stands in contrast to Regulation D offerings, which restrict participation to accredited investors with significant net worth or income.

“Ordinary investors are the most vulnerable,” explained Scott Purcell in The Crowdfunding Textbook. “When platforms promise outsized returns without regulatory oversight, the risks of fraud increase dramatically.”

Regulatory Referrals

Following growing concerns, reports have now been filed with both the SEC’s Division of Enforcement and FINRA, according to sources familiar with the matter. The SEC accepts tips through its Tips, Complaints, and Referrals (TCR) system, and FINRA encourages investors to report suspected fraud.

Whether regulators will act against Fund Finance remains to be seen. Past cases show enforcement agencies often wait until significant investor harm is demonstrated before bringing charges.

Lessons for Investors

Even without formal enforcement action, Fund Finance provides a timely reminder of the due diligence needed in today’s crowdfunding and fintech markets:

- Verify Registration – Check SEC EDGAR, FINRA BrokerCheck, and state securities regulators to confirm legitimacy.

- Beware Unrealistic Returns – Daily yields of 3–5% are not consistent with legal, sustainable investments.

- Demand Disclosures – Legitimate crowdfunding offerings provide detailed offering circulars, risk factors, and financial statements.

- Report Suspicions – The SEC, FINRA, and the FBI’s Internet Crime Complaint Center (IC3) accept investor complaints.

Fund Finance may market itself as a forward-looking crowdfunding platform, but its promises raise serious questions under U.S. securities law. Until regulators complete their review, the site remains a case study in why investor education and skepticism are critical.

As crowdfunding continues to grow, so too does the need for vigilance. For every legitimate startup seeking capital through regulated channels, there are questionable actors exploiting the crowdfunding boom with offers that sound too good to be true, because, more often than not, they are.