The Promise and the Reality

Equity crowdfunding was sold to the world as a democratizing force. No longer would early-stage investing be the exclusive playground of Silicon Valley insiders and institutional funds. Regular people could finally put their money behind the next Uber, Tesla, or Airbnb.

But a decade in, the sheen has worn off. Platforms are increasingly desperate for deal flow. The result? Many of the offerings that make it to market today would be laughed out of the room in a venture capital pitch meeting.

Which brings us to BoatBites.

The BoatBites Pitch

BoatBites, based in St. Petersburg, Florida, is pitching itself as the UberEats of open water. The idea: food delivery for boaters who don’t want to cut the engine and head back to shore.

It’s a colorful concept. It’s also currently raising money through DealMaker Securities under a Regulation Crowdfunding (Reg CF) exemption. According to investment research outfit KingsCrowd, the company is claiming a pre-money valuation of $40.4 million.

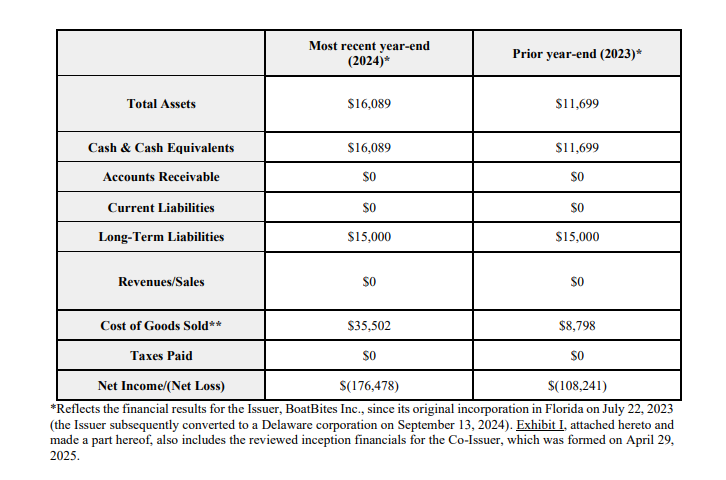

Here’s the kicker: BoatBites reported $0 in revenue for 2024. The company had about $16,000 in cash, $176,000 in net losses, and a few months of financial runway. In any rational market, that would be worth, at best, a modest seed valuation.

Instead, it’s being marketed to the crowd at a price tag more in line with a Series B tech darling.

A Timeline That Doesn’t Add Up

Digging into BoatBites’ own Form C filed with the SEC raises even more questions.

- The company was originally incorporated in Florida on July 22, 2023.

- It then converted to a Delaware corporation on September 13, 2024.

- The filing further references a co-issuer formed on April 29, 2025, a date that, bizarrely, is after the filing itself.

For investors, this reads less like a clear corporate history and more like a shell game. Which BoatBites are they actually investing in? The Florida entity that barely had a year of life? The Delaware conversion with no operating history? Or the mystery co-issuer that technically didn’t exist at the time of the offering?

At best, this is sloppy. At worst, it raises serious disclosure concerns. Either way, it puts ordinary investors in an impossible position: how do you perform due diligence on a moving target?

A Mess of an Offer Page

If you need more evidence that this campaign wasn’t ready for prime time, look no further than the BoatBites offering page. It is, quite frankly, a mess. The layout is disorganized, the narrative is shallow, and key financial information is buried or missing entirely. Instead of instilling confidence, the page looks rushed and amateurish, as though it was thrown together to get something live rather than to seriously court investors. And, it looks like most of it was a copy-paste from an AI tool like ChatGPT.

A $40 million valuation deserves, at minimum, a polished, professional investor-facing page. What BoatBites is showing the public instead only reinforces the sense that this offering is more about optics than substance.

Red Flags Everywhere

BoatBites isn’t a unique case, it’s a microcosm of broader structural problems in equity crowdfunding. But its offer checks nearly every red-flag box that seasoned investors warn about.

1. Absurd Valuation.

Valuing a pre-revenue startup with a month of runway at $40 million is less finance and more fantasy. It’s the kind of number that only gets past because platforms need deals to show their pipeline isn’t dry.

2. Minimal Runway.

According to KingsCrowd, BoatBites had $16k cash on hand, barely enough to cover salaries and marketing for a few months. That puts it in “going concern” danger territory before the offering even launched.

3. Track Record Confusion.

With the corporate shuffle between Florida, Delaware, and a mystery co-issuer, investors are being sold a story that doesn’t align cleanly with reality.

4. Shoddy Offer Page.

The poor quality of the offering page itself is a red flag. If a company can’t invest in a professional, clear, and transparent pitch, why should investors believe they can execute on an ambitious business plan?

5. Platform Gatekeeping Failure.

DealMaker has historically been seen as a stronger platform, hosting cleaner, higher-quality offerings. Their willingness to green-light BoatBites suggests either their filters are loosening, or they’re feeling the same deal-flow pressure plaguing the rest of the industry.

The Bigger Problem: Desperation for Deals

The BoatBites story matters because it illustrates the larger credibility crisis facing equity crowdfunding.

High-quality startups with traction and strong investor networks don’t often turn to Reg CF. They raise from angels, seed funds, or venture capital. What ends up on the portals, all too often, are companies that couldn’t pass those filters.

InvestmentBank.com put it bluntly: “Many campaigns are more examples of failure than success.” Why? Because the best startups never needed the crowd in the first place.

In this vacuum, platforms are forced to choose between publishing weak deals or publishing no deals. And given the economics of “no deals” isn’t an option, the weak ones appear to be slipping through.

The Investor Trap

The result is a dangerous cocktail for retail investors. Research has shown that signals often used to justify investments with slick updates, large commitments from “lead investors,” founders with flashy pedigrees, which don’t actually predict success. In fact, sometimes they predict failure.

Add in the statistic that 90% of startups fail, and it’s clear that many crowdfunded investors are being set up to lose money before they’ve even hit the invest button.

BoatBites’ valuation gymnastics, messy offer page, and corporate shape-shifting only make that trap more obvious.

Why This Should Alarm Regulators and Platforms Alike

When platforms like DealMaker start hosting companies with red flags this blatant, they risk something much larger than one bad campaign, they risk eroding public trust in the entire model.

The JOBS Act gave equity crowdfunding life, but it also gave it scrutiny. The SEC isn’t likely to ignore filings that include entities incorporated after the offering date. Nor will it ignore valuation practices that look like bait for unsophisticated investors.

For platforms, credibility is their only currency. Once retail investors begin to feel the game is rigged, they’ll retreat, and the model collapses under its own weight.

Fool’s Gold on the Water

BoatBites may yet prove skeptics wrong. Perhaps they’ll crack the logistics of delivering tacos and cocktails to yachts without sinking themselves. Stranger things have happened.

But judged on its own offering, it looks like a case study in what not to back: no revenue, no runway, a dubious corporate history, a messy campaign page, and a valuation pulled seemingly from thin air.

Equity crowdfunding promised access to the next big thing. Instead, too often, it offers access to the next cautionary tale. And unless platforms get serious about quality control, they’ll keep flooding the market with fool’s gold until no one trusts the stream.