This is an opinion piece based on my personal research into a “Going Public”, owned and operated by Crush Capital Inc. an entertainment company that produces the Going Public docuseries, its management and issuers.

Darren Marble and Todd M. Goldberg are the co-founders and co-CEOs of Crush Capital, a fintech firm established in 2020 with the mission to democratize access to investment opportunities for retail investors.

Darren Marble

Darren Marble is a serial entrepreneur based in Los Angeles, California. Prior to founding Crush Capital, he served as the CEO of CrowdfundX, a financial marketing firm specializing in Regulation A+ offerings, where he played a pivotal role in marketing historic Reg A+ IPOs to NASDAQ and NYSE. CrowdfundX were the agency involved in promoting one of the very first questionable REG A+ deals, Elio Motors. Investors who invested into that campaign have lost all hope whatsoever of getting any returns.

Todd M. Goldberg

Todd M. Goldberg has a background in sales and business development within the medical technology sector. He has achieved two exits in his career as Senior Vice President of Sales for MedTech companies Advanced Bionics (acquired) and Neuronetics (IPO).

Crush Capital and “Going Public”

Together, Marble and Goldberg co-founded Crush Capital, which is the creator of the “Going Public” docuseries, an interactive streaming series that allows viewers to invest in companies as they watch entrepreneurs raise capital. The series aims to empower retail investors by providing access to IPOs and other financial products that were previously reserved for the wealthy and connected.

Marble and Goldberg’s combined expertise in fintech, marketing, and business development has been instrumental in advancing Crush Capital’s mission to democratize the IPO process and provide retail investors with unprecedented access to investment opportunities.

“Going Public” positioned itself as a trailblazing concept. The show brought the drama of startup fundraising to the small screen, allowing viewers not only to watch but to invest in real-time. Yet, beneath the allure of innovation, celebrity endorsements, and high-profile partnerships lies a sobering reality: the series has struggled to deliver meaningful results for its participating companies.

This article takes an investigative look into “Going Public,” dissecting its premise, execution, and ultimate impact—or lack thereof—on the startups it aimed to support.

The Premise: A Revolutionary Investment Opportunity

“Going Public” was marketed as a groundbreaking platform merging entertainment with equity crowdfunding. The show allowed viewers to participate in the financial journeys of founders raising capital through Regulation A+ (Reg A+) and Regulation Crowdfunding (Reg CF). With a “Click-to-Invest” feature, the series promised to democratize investment opportunities, empowering retail investors to support companies they believed in while watching their stories unfold.

Season 1 premiered in 2021, and Season 2 followed in 2024, building on the initial concept with celebrity hosts, bigger partnerships, and wider distribution.

The Star Power and Media Backing

The show’s partnerships and marketing efforts were nothing short of ambitious. For Season 2, “Going Public” secured a distribution deal with MarketWatch, a financial media platform boasting over 50 million monthly unique visitors. This partnership included promotional backing from the Wall Street Journal Delivery Network, Barrons.com, Investors.com, and their associated YouTube and Meta properties. Additionally, the series tapped into celebrity appeal with personalities like NBA star Baron Davis and boxer Floyd Mayweather Jr.

Despite these resources and visibility, the series’ core offering, raising significant funds for its participating startups has failed to materialize.

The Reality: Poor Fundraising Outcomes

Season 1: Modest Results and High Costs

The inaugural season showcased four companies leveraging Reg A+, a crowdfunding exemption allowing retail investors to participate.

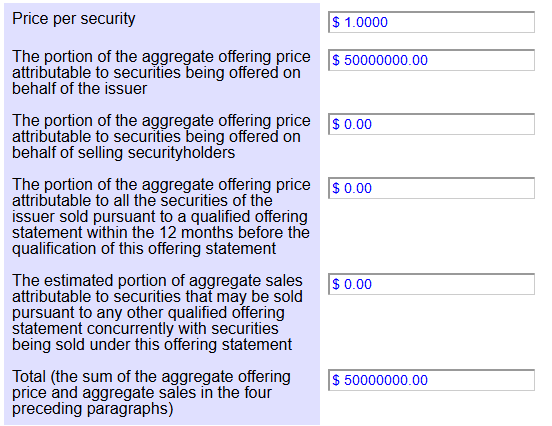

TREBEL Targeted a fundraising amount of $50M

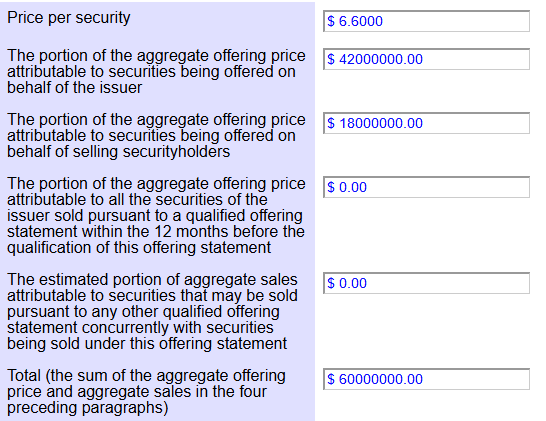

PROVEN Targeted a fundraising amount of $60M

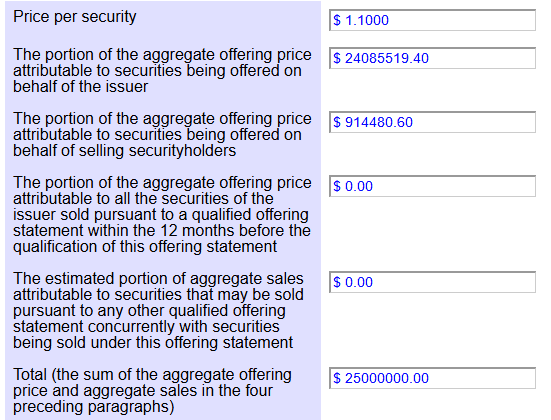

HAMMIT Targeted a funding amount of $25M

NGT ACADEMY Targeted a funding amount of $72M

Collectively, these companies targeted a funding amount of $207M but raised only $15M (7.24%), an underwhelming sum given the capital they sought and the expenses involved. Alarmingly, only $5 million of this total came from retail investors; the remaining $10 million originated from institutional and accredited investors. Dismal results such as these from huge exposure, certainly sets off alarm bells as to something being seriously wrong with the format.

The financial toll on participating companies was steep:

- Some issuers paid approximately $250,000 in production fees.

- Additional costs included around $100,000+ for legal and accounting services.

- Companies also surrendered equity as part of their agreements with the show.

When compared against the funds raised, these expenditures highlighted a troubling imbalance. Companies faced significant upfront costs with little guarantee of success, raising questions about the show’s viability as a capital-raising platform.

Season 2: A Continuation of the Struggle

For some reason during season 2, all issuers were raising capital using the REG CF exemption, but this second season saw even worse outcomes. Despite increased exposure and celebrity involvement, the companies featured in Season 2 fared poorly:

MAX INTERNATIONAL: Targeted a funding amount of $5M but has only raised $27,411.25 to date.

SALEEN: Targeted a funding amount of $3.945M and only raised a total of $424,142.50

Amount raised $424,124.50

Both companies utilized the Reg CF exemption, which simplifies crowdfunding for smaller amounts but still requires substantial effort to attract investors. These dismal figures underscore the ongoing challenges faced by startups featured on the show.

Why “Going Public” Has Failed

The concept of “Going Public” is undeniably innovative, but its execution has revealed systemic flaws. Several factors may explain its inability to deliver for participating companies:

- Entertainment Over Substance The show’s reality TV format prioritizes storytelling and drama, potentially at the expense of serious investment discussions. Investing in startups requires thorough due diligence, risk assessment, and a deep understanding of financials—elements that may be overshadowed by the series’ entertainment-first approach.

- Audience Mismatch While the “Click-to-Invest” model is intriguing, it demands a financially literate and engaged audience. Retail investors, particularly those drawn to the show for its entertainment value, may lack the confidence or expertise to make informed investment decisions.

- Market Conditions Economic volatility during both seasons may have discouraged investment. Retail investors often become more risk-averse during uncertain times, opting for safer financial instruments over speculative ventures.

- High Costs for Startups The substantial fees required to participate in “Going Public”—along with the need to allocate equity—place a significant burden on startups. For early-stage companies with limited resources, these costs may outweigh any potential benefits.

- Weak Company Selection The success of equity crowdfunding often hinges on a strong narrative and a compelling value proposition. If the featured companies fail to resonate with viewers or demonstrate clear growth potential, they are unlikely to attract significant investment.

- Regulatory Complexities The legal and financial intricacies of Reg A+ and Reg CF offerings can be daunting for both companies and investors. The show may not provide sufficient clarity or education on these issues, deterring potential backers.

A Broader Reflection on Media-Driven Crowdfunding

“Going Public” offers a cautionary tale for ventures at the intersection of media and finance. While the concept of combining reality television with investment opportunities is novel, its practical application requires a delicate balance between entertainment, investor education, and financial transparency.

The show’s shortcomings suggest that democratizing access to capital markets is far more complex than simply making investing accessible. Success in this domain requires:

- Building Trust: Retail investors need confidence in the platform and the companies it features.

- Enhanced Financial Literacy: Viewers must understand the risks and rewards of equity crowdfunding.

- Stronger Partnerships: Collaborations with credible financial institutions and advisors could lend legitimacy to the platform.

- Improved Company Vetting: Featuring startups with stronger fundamentals and clearer value propositions could enhance investor interest.

Lessons for Entrepreneurs and Investors

“Going Public” aspired to revolutionize startup fundraising by blending entertainment with investment. Unfortunately, its financial outcomes for participating companies paint a starkly different picture. The series’ inability to deliver meaningful results highlights the challenges of merging these two worlds effectively.

For entrepreneurs, the experience of “Going Public” underscores the importance of thoroughly evaluating the costs and benefits of high-profile opportunities. For investors, it serves as a reminder to prioritize due diligence and informed decision-making over flashy marketing.

As the industry continues to experiment with new approaches to crowdfunding, the lessons of “Going Public” will undoubtedly inform future efforts. For now, the series remains a testament to the challenges, and potential pitfalls, of trying to reshape how the world invests in startups.