I have been asking this question and answering it several times on social media over the years. But, I still don’t get it why the majority of crowdfunding portals and platforms don’t get this yet. It’s quite common to see an “offer” with a close date of 6,9, or even 12 months into the future.

I’m an investor…

Imagine yourself as an investor. You stumble upon an intriguing opportunity through an introduction, an ad, a social media post, an article, or even local press. Curious, you visit the promoted website and find a well-designed landing page with all the details you need. But then you notice the close date: July 2025. Today is July 2024!

As an investor, you’re likely to:

- Read a bit more and move on.

- Schedule a reminder to check back closer to the closing date.

- Never invest.

Here’s the issue: a significant portion of your marketing budget is wasted. By the time an interested investor returns in 6, 9, or 12 months, how many other great investment opportunities will they have encountered? Probably quite a few.

And there lies the problem! A very high percentage of your marketing dollars are down the pan. By the time a potential investor has come back to your deal in 6- 9 months, how many other investment opportunities may thay have seen? A lot!

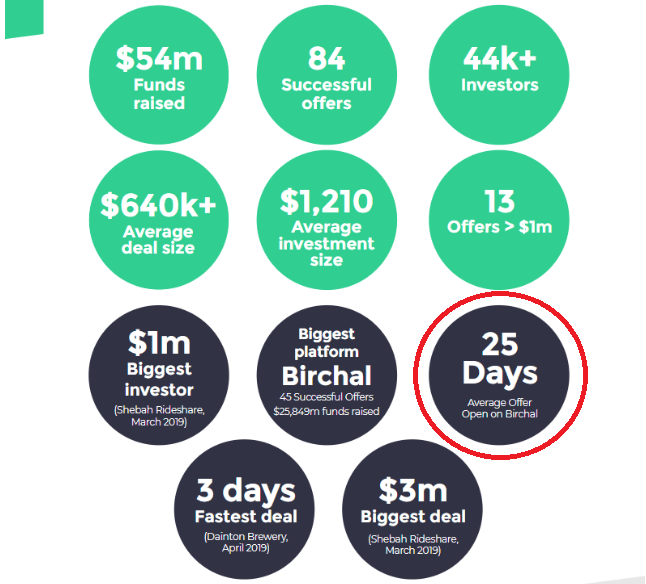

Recent data out of Australian Fintech company Birchal, shows their average live offer time of only 25 days! They’ve learned quickly, as have others. But, most are still asleep at the wheel.

Crowdfunding can be easier, when you mix FOMO into the equation.

However, gaining immediate traction with your campaign is the most important of all. This can only be achieved through a 30 to 45 day prelaunch period of marketing preparation and targeted investor database development. Traction means many investments on day one. Money attracts more money, opening doors which allow you to amplify your messaging to a much larger audience via media opportunities.

Consider shortening those close dates, capture interest while it’s fresh, and maximize your chances of closing your rounds much quicker.